R&E part 2 (10:38 pm 9/24/2009) – How can I forget my hat-tips? Patrick and Huckleberry Dumbell were all over this before I got to it.

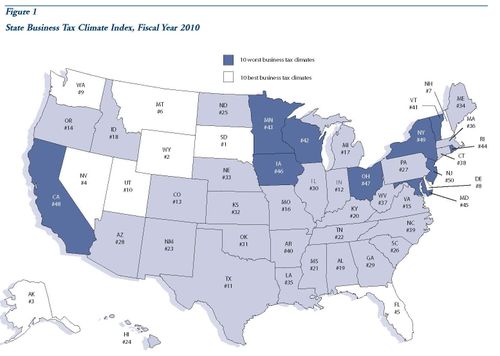

Shoebox reported on the Tax Foundation’s 2009 Business Tax Climate report, which put both Wisconsin (43rd) and Minnesota (44th) in the Doghouse Ten. Forbes has some relatively-good news for one of those states, and some really-bad news for the other:

– Minnesota, buoyed by its 6th-best quality-of-life and top-10 labor rank, ranked as the 17th-best state for business. However, the news isn’t all good; its growth potential was the only other of Forbes’ 6 criteria to rank in the upper half (20th), with its regulatory climate (30th), business costs (32nd) and economic climate (35th) below par. Worse; it slipped from 11th just last year.

– Wisconsin, on the other hand, is the third-worst state for business, behind only Michigan and Rhode Island. The only above-average item in Wisconsin is quality-of-life (11th), with business costs ranking 35th, labor rank 36th, regulatory climate 37th, economic climate 41st and growth prospects 45th. Like Minnesota, Wisconsin slipped from last year; unlike Minnesota, the fall was from 43rd to 48th.

Why do I get the feeling that weighed in on Ron Kind’s decsion to stay in Congress?

Revisions/extensions (10:35 pm 9/24/2009) – Corrected the 2008 Wisconsin rank.