Ed Morrissey obtained the summer 2009 Congressional Budget Office report on the health of the Social Security “Trust Fund”, and the news isn’t good. The same CBO that, last year under now-Obama budget director Peter Orszag, claimed that the combined OASDI trust fund would not begin to run a primary deficit (what Ed calls a cash deficit and what I’ve called an ex-interest deficit) until 2019, is now saying, at least to Congressmen, that it will run a primary deficit in 2010 and 2011, briefly run a cash surplus between 2012 and 2015, and return to what is presumably a permanent primary deficit in 2016.

I guess that is what the ranking member on the House Committee on Financial Services, Rep. Spencer Bachus (R-AL) was refering to when he told his hometown paper that Social Security would go into the red before 2012 if things didn’t improve dramatically. The 2010 primary deficit is also something predicted in the 80%-confidence curve of the stochastic model.

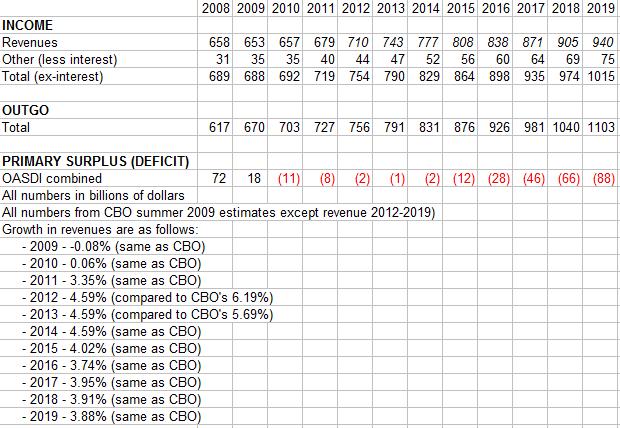

I do have a problem with the CBO’s numbers starting with 2012, when they claim that the OASDI primary surplus would begin its last run in the black. They assumed a 6.19% growth in revenues derived from the payroll tax in 2012, and a 5.69% growth in revenues in 2013. I decided to re-run the numbers using the still-high 4.59% growth in revenues called for in 2014 for those two years, and low-and-behold, the primary deficit never quite turns around:

On a related note, the Office of the Chief Actuary does not have the August 2009 “trust fund” performance available yet. However, the 12-month primary surplus between August 2008 (when the “trust fund” began running monthly primary deficits) and July 2009 is only $32.5 billion, with 8 of the 12 months having a primary deficit.

Revisions/extensions (10:27 am 9/22/2009) – Corrected a typo due to a misread of the chart. The CBO predicts permanent red ink for Social Security beginning in 2016, not 2017.

R&E part 2 (10:49 am 9/22/2009) – A couple of housekeeping items:

First, thanks for the link, Ed. Without you getting the numbers out of the CBO, I wouldn’t have been able to run with them.

Second the cumulative 10-year primary deficits of $152 billion (if CBO’s numbers are right)-$264 billion (if my numbers are right) will need to be added to the overall 10-year deficit of $9 billion and overall projected debt of $22 billion as they are currently unfunded liabilities.

R&E part 3 (6:02 pm 9/22/2009) – In case you missed the trackbacks on Hot Air, some more good reading can be found at both Ace of Spades HQ and Daily Pundit. Bill Quick notes that the bipartisan Party-In-Government will not let SocSecurity fail spectacularily, though I note that the numbers simply aren’t there for a 1983-style fix, and that final failure isn’t slated for another 25 or so years. The Morons are, as always, our informative and entertaining selves.

R&E part 4 (10:45 am 9/24/2009) – The conversation continues above, with some new numbers from both Tom Blumer and the Social Security Administration.

[…] II: Steve at No Runny Eggs, who has been keeping a very close eye on SSA, says that the CBO numbers project some eye-popping […]

Thanks for the projection. A couple of questions:

1) am I right in assuming that the quarterly bumps in inflows are due to quarterly filers (self-employed)? Those are big numbers, almost so big that a slight decline in payments from those filers (whomever they are) would be bad news. Do we know who they are?

2) Do the funds follow a calendar year or a federal year, for accounting purposes? I ask because I was wondering what it would take to push the 2009 results into the red, and so how far we are through the year really matters. If it’s a calendar year and the 2009 year shows a decline of 3.495% instead of a decline of only .08%, then the “Trust Fund” looks like it could be in current deficit as early as this year. Either way, 2010 is staring us in the face (maybe as soon as next month, if the fund follows a federal accounting year).

Thanks for the work.

In reference to the first question, there are several different “bumps”:

– The bumps in January, April, June and September in what the CBO calls “revenues”, what SocSecurity calls “contributions”, and what everybody else calls the payroll tax are indeed due to those who file quarterly. Related to that, the huge spike in April, as well as the smaller spike in March, are due to those who should file quarterly but forget.

– The separate bumps in January, April, July and October are due to most of the taxed Social Security benefits hitting the “trust fund” those months.

– The semi-annual bumps in “interest” (June and December) are when the interest on the long-term bonds are compounded.

As for how that stacks up to the last 12 months figures are available, the 4 months that had a monthly primary surplus were Septmeber 2008, January 2009, March 2009 and April 2009. Notably, neither June 2009 (the tax-year/calendar-year 2009 2nd quarter for quarterly-filers) nor July 2009 had a monthly primary surplus.

In reference to the second question, those are fiscal years, which begin October 1 in the Federal world. I’m not going to hazard a guess on whether calendar-year 2009 will end up in the red, but I note that the CBO is suggesting that August and September will come in at a $14 billion primary deficit. That would mean October-December would have to come in at about a $21.5 billion primary deficit to put Social Security in the red for CY2009.

[…] Lots of charts and numbers and stuff at the link. And fellow Blogosphere’o'Cheeser Stevegg makes an appearance in an update! […]

[…] out their update: Steve at No Runny Eggs, who has been keeping a very close eye on SSA, says that the CBO numbers project some eye-popping […]

[…] Folks, do check out Steve Egg’s layout of the numbers. I still think SS can be “fixed,” but the fix might involve you having to live until […]

[…] to future year collections, Morrissey points to work by “steveegg” at No Runny Eggs showing that tweaking CBO’s rather optimistic assumptions of payroll tax growth downward by […]

Look, I don’t like taxes any more than the next guy, but is it at all possible that we are not allocating enough to handle the increased demands by social security? The choice is to send seniors to the bread lines, or adjust our spending upward to allow for the boomer’s peak and longer life spans, and then reduce them later to suit. Or we can just put us old fogies on the public dole some other way.

But worse than over-spending on a system that cares for our elderly is the corrupt giveaways of taxpayer assets to the special interests that fund the political elections. Perhaps if we eliminated that we could reduce taxes and at the same time resolve our SSI and health care problems.

Jack Lohman

http://MoneyedPoliticians.net

[…] was originally going to append this to my post from the other day, but there are too many new items to […]

[…] to slightly-higher-than-projected revenues, it does not represent any meaningful improvement in the ugly projections for the future. That also was the worst 12-month performance since January 1993-December 1993, and the worst […]

[…] in September, Ed Morrissey found, and I expanded upon, a dire look at the Social Security “Trust” Funds from the Congressional Budget Office […]