Former Fed Chairman, Alan Greenspan has been getting more and more vociferous in his defense that his easy interest policies, post tech wreck were not responsible for the housing bubble that led to our current wreck. In an article by Reuters, Greenspan said:

“Between 2002 and 2005, home mortgage rates led U.S. home price change by 11 months. This correlation between home prices and mortgage rates was highly significant, and a far better indicator of rising home prices than the fed-funds rate.”

and

Greenspan wrote that “it was indeed lower interest rates that spawned the speculative euphoria. However, the interest rate that mattered was not the federal-funds rate,” adding that U.S. mortgage rates’ linkage to short-term rates had been close for decades.

However, the article goes on to say that the Fed should have had some inkling that there was an issue as early as 2004:

The Federal Reserve became aware of the disconnect between monetary policy and mortgage rates when the latter failed to respond as expected to the Fed tightening in mid-2004, said Greenspan, who was the Federal Reserve Chairman from 1987 to 2006.

Wow, oh Al is certainly using some challenging language there. Let me see if I can decipher it.

If I put Al’s defense into straight English it would looks something like this:

Between 2002 and 2005 home price increases were driven by low mortgage interest rates. However, the low mortgage interest rates were not caused by the low fed-funds rate. Rather, mortgage rates had always been driven by short term interest rates.

My first response is Huh? Has Al finally crossed into the final mental frontier? What does Al believe drives short term rates? You guessed it, Fed-fund rates or a proxy for them, the prime rate.

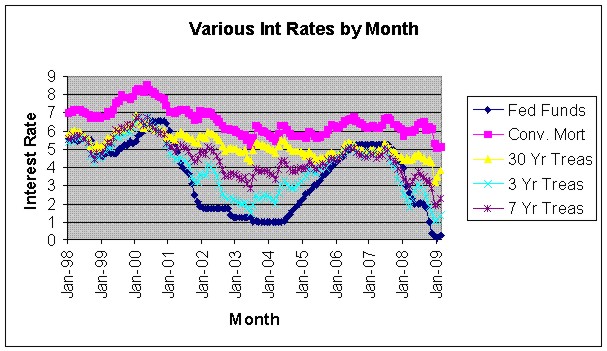

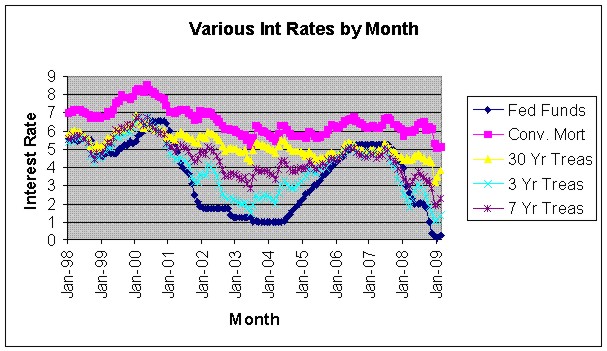

Look at the attach graph. It’s rough but you’ll get the idea. I’ve plotted the average mortgage rate, the fed-funds rate and Treasury rates at three different maturities. The graph starts in January, 1998 and goes through February of 2009.

Here’s what you note:

Going into the tech wreck as interest rates hit their peak (late 2000), all of the Treasury rates had fallen below the Fed Funds rate. Note that this same phenomena occurs in the January, 2007 time frame also, nothing to see here. Note also that the mortgage rates were nominally above the fed-funds rate at both of these times.

Now, look at the trough between January, 2002 and late 2004. While the shorter term Treasuries dipped with the fed-funds rate, the 30 yr and the mortgages dipped far less. During this time frame there was a significant and unusual spread that lending institutions were making in that while they were borrowing at something close to the fed-funds rate they were lending at the much higher mortgage rate. This increased spread is what allowed significant money to be made in mortgages during this time. It was also this spread, additional profit to various institutions, that was used to allow aggressively bought down “teaser rates”, no payments for the first X months and other promotional offers to get people to purchase mortgages.

Another thing that changes during this “trough time” was the dramatic increase in sub-prime or Alt-A mortgages. These mortgages became a higher and higher percentage of all mortgages during this time peaking at 13.4% of total loans in 2006. These loans became available because the significant spread that lenders were making on loans allowed them to leverage it by taking on even riskier loans. The fact was that they were making enough on all the other loans, because the Fed had reduced rates, that it allowed them to take the additional risk. As you well know, these sub-prime loans are a big portion of the bubble pop that has us where we are at.

Finally, Greenspan’s notion that the housing prices weren’t driven by the fed-funds because mortgage rates follow short term rates and didn’t this time is nonsense. Think back during this time. If you wanted a mortgage, you were often waiting weeks if not months to get the mortgage completed. Why? Because the rates were low enough, as low as they had been for a generation, to get all the business they needed to keep busy. The mortgage rates didn’t need to go any lower than they were because they were getting all the business they could handle. They had found the perfect spot where in economic terms they were receiving the highest marginal value for each additional unit (mortgage) they produced. One may ask why, in a capitalistic system, there wasn’t competition to drive the rates lower when the margins were so high? The answer is that with Fannie and Freddie controlling 90% of the secondary mortgage market, there really isn’t true competition in the mortgage market.

Sorry Al. Just because you didn’t see the same trend as the historical trend doesn’t make it untrue. While I didn’t always agree with your actions, I do believe you were a public servant in the best sense of that phrase. Stop with the attempt at revisionism. You had a number of years of great success but in this case Al, you blew it.