The Social Security trustees released their annual statement of the states of the Social Security and Medicare trust funds yesterday, and things are very ugly. From the “Intermediate Case”:

– The Disability Insurance (DI) portion of Social Security, which has cost more to run than its dedicated tax revenue source provides (i.e. it’s running in the red) since 2005, will have its “trust fund” exhausted in 2020.

– The Old-Age and Survivors Insurance (OASI) portion of Social Security will begin to run in the red in 2017.

– The combined Old-Age and Survivors and Disability Insurance (OASDI) “trust fund” will begin to run in the red in 2016, with “fund” exhaustion in 2037.

– The Hospital Insurance (HI) portion of Medicare, which began to run in the red last year, will exhaust its “trust fund” in 2017.

– The Supplementary Medical Insurance (SMI) portion of Medicare, which funds both outpatient care (Part B) and the prescription drug benefit (Part D), only avoids “trust fund” exhaustion because automatic increases from both the enrollees and the general fund. Even here, there is a big warning – because most of the enrollees are protected from the bulk (and for at least this year, any) increase in Part B fees under a “hold-harmless” provision, those not covered by the provision (high-income, new enrollees, and the states through Medicaid) will be facing an extraordinary increase in fees.

Rep. Paul Ryan (R-WI – and my Congressman) notes that the 75-year unfunded liability in the programs increased from $40 trillion last year to $43 trillion this year. That $3 trillion increase is rather close to the proposed 2010 budget. He also notes that, despite these serious problems, the Obama administration wants to expand entitlement spending like the programs listed above by $1.4 trillion over the next 10 years.

Ed Morrissey connects the dots and finds, that among other things, credit default insurance on US Treasury debt briefly cost more than credit default insurance on McDonald’s debt. Also, there was a nearly-failed 30-year T-bond auction last week, rescued only after the Treasury raised the interest rate it will pay on the bonds.

But wait, it gets worse. Chuck Blahous read the stochastic projections stuck in one of the appendices of the OASDI report. Before I continue with the bad news, allow me to briefly explain what the stochastic projection is, and how it’s different from the “deterministic” model that the Intermediate Case and the other two main cases the majority of the report uses. The “deterministic” model uses a carefully-selected assumption of various variables, which for the most part, do not change once the variables reach the ultimate conclusion. The stochastic model creates an equation that allows the variables to fluctuate randomly within parameters set by historical records. Specifically in this case, the equations were written so that, without the random fluctuations, the “Intermediate Case” numbers would be the result.

The math geniuses then ran the numbers with the combined OASDI “trust fund” 5,000 times to come up with a spread of projections, and then came up with a probability curve based on the results. The median (50th percentile) projections were that Social Security would first run in the red in 2014 (2 years earlier than the “Intermediate Case”), and the “trust fund” would first be exhausted in 2036 (1 year earlier than the “Intermediate Case”; note that not all the simulations predict a permanent exhaustion of assets the first year of exhaustion).

What is more interesting is what the stochastic model predicts with 80% confidence (between the 10th percentile and the 90th percentile) and with 95% confidence (between the 2.5th percentile and the 97.5th percentile). With 80% confidence, the stochastic model predicts that Social Security would first run in the red sometime between 2010 (that’s next year, folks) and 2017 (a mere year after the “Intermediate Case”), with first-year exhaustion sometime between 2032 and 2043. With 90% confidence, it predicts that Social Security will begin to run in the red sometime between 2009 (that’s this year, folks) and 2019, with first-year exhaustion sometime between 2030 and 2052.

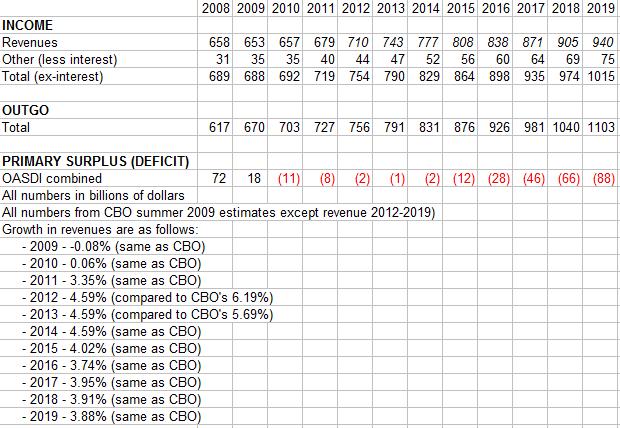

How likely is it that Social Security would go into the red this year? Chuck notes that the 2009 “cash surplus” projection (total revenues minus both total expenses and “net interest”, which really is an unfunded liability and not an asset) is down from $87 billion this time last year to $19 billion (actually, $18.8 billion) this year under the “Intermediate Case” projection. It also is down from a “cash surplus” of $73.7 billion last year.

Meanwhile, Ed noted the beginnings of something interesting regarding the OASDI “trust fund” – it ran a negative balance in February. I ran with that, and found that 4 of the last 8 months (August 2008-March 2009) were officially negative: August 2008, October 2008, November 2008, and February 2009. Toss out the “net interest” that propped up December, and it’s up to 5 of the last 8 months.

Because revenues (as well as the misapplied “net interest”) do not come in nearly as regularily as expenditures go out, it is a bit of a reach to say that Social Security is officially in the red. After taking out the “net interest”, the last 8 months saw a “cash surplus” of $14.7 billion, and the last 12 months saw one of $52.2 billion. That is compared to an 8-month “cash surplus” of $38.0 billion between August 2007 and March 2008, and a 12-month “cash surplus” of $76.9 billion (corrected the decimal) between April 2007 and March 2008.

I might not bet on Social Security running red for a 12-month period this year, but I’ll take the “early” in just about any pool.