There’s been a lot of numbers and rhetoric tossed about on what the debt deal (shortened to The Deal, not because I like it, but because it makes the phrase stand out) does and doesn’t do. However, I don’t believe anybody has done an exploration of the absolute effect is. It’s high time to do so.

Baselines matter

First, the base from which the reductions are to be needs to be established. While that base has been established to be a “modified” version of the March 2011 Congressional Budget Office extended-baseline scenario, a quick review of which is part of the CBO’s review of the President’s FY2012 budget proposal.

The extended-baseline scenario assumes the CBO’s estimates, based on current law and not necessarily current policy, of direct spending (which, among other things, ends the Medicare “doc fix”) and revenues (which, among other things, assumes that all of the Bush tax rates expire at the end of 2012 and the Alternate Minimum Tax is no longer “indexed” to keep middle- and lower-income Americans from being caught in that trap), and that every top-line category of discretionary spending that does not explicitly end in FY2010 is increased at the rate of inflation.

The bottom line on that is that, on $39.03 trillion in revenue and $45.77 trillion in outlays, there would be $6.74 trillion in deficit spending. However, there are a couple of “wrinkles” that were added to that in the baseline used.

Normally, that would include spending on what used to be known as (and is still called by the Republicans on the House Budget Committee) the Global War on Terror. However, every entity, from the White House to the House of Representatives to the Senate Democrat leadership, agrees that, instead of spending $1,589 billion over the next 10 years as the extended-baseline scenario calls for, $545 billion will be spent. While the CBO excluded the entirety of that at the request of Congress as it is not part of this bill, I will add the $545 billion back in, using the House budget spending by year, as there is no difference year-to-year between the President’s and the House of Representatives’ budgets.

Also, the CBO, at the request of Congress, has figured in the effects of the final FY2011 continuing resolution. That is another $122 billion reduction in spending.

Taking the full effect of those modifications into consideration, the federal government would take in $39.03 trillion in revenue, spend $44.60 trillion, and run a 10-year deficit of $5.57 trillion.

There are a couple of other “baselines” that one could choose. The President’s budget, according to the CBO, would take in $36.70 trillion in revenue, spend $46.17 trillion, and run a 10-year deficit of $9.47 trillion. That budget already includes all of the modifications above.

An “Alternate Fiscal Scenario” from the CBO, which assumes various spending and revenue options, including those outlined above, are affirmatively extended rather than allowed to expire or otherwise not happen and last outlined in percentage-of-GDP form in June, would also need to be adjusted by the above adjustments. Once that is done, it would presume $35.05 trillion in revenues, $46.81 trillion in spending, and $11.76 trillion in deficits.

Meanwhile, the House budget, which keeps all of the Bush tax rates, indexes the AMT, and does some further tax cuts, envisions $34.87 trillion of revenues, $39.96 trilion of spending, and $5.09 trillion of deficit spending. Like the President’s budget, it already includes all the modifications above.

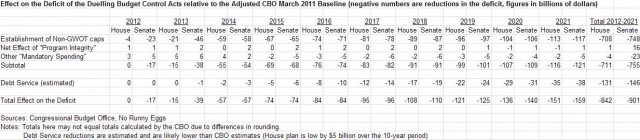

The first 2 years – $63 billion in scorable deficit reduction versus the “adjusted” CBO baseline

Like the CBO, I cannot and will not attempt to score the effects of a potential $1.2 trillion in “trigger” cuts, $1.5 trillion in “commission” cuts, or adoption of a Balanced Budget Amendment. However, I have actually read the bill, and the discretionary spending caps are, unlike the $1.2 trillion-$1.5 trillion in “additional cuts”, actual hard numbers, not nebulous percentages or “reduction” numbers”. Therefore, actual bottom-line spending comparisons can be made against any base. As the CBO used an adjusted version of their March 2011 baseline, I added the (all-but-)agreed-to spending levels on the GWOT to do so.

Using the adjusted CBO baseline, there would be, between FY2012 and FY2013, $5.65 trillion in revenue, $7.34 trillion in spending, and $1.69 trillion in deficit spending. Adopting The Deal l would knock the spending down to $7.28 trillion and deficits down to $1.63 trillion.

By way of comparison, the President’s budget would have $5.44 trillion in revenue, $7.51 trillion in spending, and $2.07 trillion in deficits. That’s an additional $233 billion in spending and $438 billion in deficits versus The Deal.

The House budget would have $5.39 trillion in revenue, $7.09 trillion in spending, and $1.69 trilllion in deficits. While spending in the House budget would be $190 billion less than The Deal and $253 billion less than the adjusted CBO baseline, the deficit would be slightly higher than The Deal and insignifiantly less than the adjusted baseline as, instead of the Bush tax rates expiring at the end of 2012 (1/4th the way through 2013) and the AMT “indexing” not happening, both would continue as they have the past 8 years.

The “out” years – $855 billion in “scorable” deficit reduction – if The Deal holds

I will preface this that there is a significant amount of debt service savings from the reductions in spending on the GWOT that were scored in the two budgets that were not scored separately in even the CBO analysis of the Senate proposals. Judging by the CBO scoring of the Senate proposal versus the House proposals and The Deal, that is roughly $220 billion in reduced spending over the 10 years not reflected in either the adjusted CBO baseline or The Deal.

Also, the bulk of the $1.2 trillion-$1.5 trillion in additional deficit reduction, or any adoption of a Balanced Budget Amendment, will happen in this time frame. As noted above, that cannot be properly scored as yet.

With that said, the adjusted CBO baseline anticipates $33.39 trillion in revenues, $37.26 trillion in spending, and $3.87 trillion in deficits between FY2014 and FY2021. The Deal changes the spending to $36.41 trillion and the 8-year deficit to $3.02 trillion.

The President’s budget is a veritable blowout of spending, especially deficit spending. On $31.26 trillion of revenue, there would be $38.67 trillion of spending and $7.40 trillion of deficits.

While the House budget would continue to spend less at $29.48 trillion, its reduced expectation of revenue of $32.87 trillion would result in $3.39 trillion in deficits.

What about tax hikes?

While The Deal does not explicitly address taxes, I’ve got bad news for everybody (or at least everybody who thinks a non-WWII record level of revenues as a percentage of GDP in 2021 is a bad idea) on that front. Any attempt to either extend any part of the Bush tax rates beyond 2012 or keep “indexing” the AMT will be scored as a deficit increase. The back-of-the-envelope numbers on the various proposals are that the “scored” increase would be about $2.5 trillion for the Obama “hold those under $200K/$250K harmless” plan, $3.5 trillion for full extension of the Bush tax rates, and $4.2 trillion to continue the entirety of the current tax structure.

What about S&P and Moody’s?

Again, baselines matter. Unfortunately, neither S&P nor Moody’s appear to have mentioned from which baseline they wanted the “$4 trillion in deficit reduction”. It has been said that Cut, Cap and Balance, even before adoption of the Balanced Budget Amendment, would have met that. However, I have not seen any CBO score on that.

Moreover, up until the Congressional leadership decided to start talking to each other instead of with President Obama, it was widely assumed the $4 trillion that was being talked about was against the President’s budget and its $9.47 trillion 10-year deficit spending. The House budget, and the Cut, Cap and Balance bill that, after higher spending in FY2012 compared to that, used percentage-of-GDP spending levels based on that budget, would easily have cleared that hurdle.

Going against the President’s budget, The Deal, with $4.65 trillion in 10-year deficit spending, also would very easily clear that hurdle, even before the “trigger”/commission/BBA. Moody’s has already said they would maintain a negative outlook on the US soverign debt, while S&P is making noises that they will downgrade the debt. I have to wonder what more those credit rating agencies want.

Revisions/extensions (4:27 pm 8/1/2011) – I really need to proofread these opii. I corrected a typo.