I’ve shared before about a General Manager that I worked for in wireless. He used to tell us “Two does not make a trend.” It was his way of telling us that we shouldn’t get too giddy about a couple of success, that we needed a string of successes before we could claim a winning idea. I never heard exactly how many did make a trend. However, I’m pretty sure that President Obama is noticing a trend.

Monday as President Obama shared his ideas for solving the high costs of health care with the AMA, he was booed. He was booed because his plan didn’t contain the obvious need to include malpractice reform in his plan.

A couple of weeks back, Treasury Secretary Tim Geithner was laughed at by Chinese University students as he told them: he stood for a “strong dollar,” but that China should let its currency appreciate relative to the dollar, which, of course, would mean a weaker dollar. He simultaneously told China that their investments in US Treasury bonds were safe.

And early last year Obama was booed by the NAACP as he tried to warm to the crowd with stunning rhetoric like:

“I eat fried chicken, why sometimes I go to bed with a bucket of KFC, so I can eat it while I fall asleep, and again when I wake up in the morning.”

My point in this is not that Obama or his administration, gets booed or laughed at. Rather, my point is that for all of the accolades about his speaking ability and intelligence, President Obama, whether with friendly, neutral or unfriendly audiences, continues to misread his audience.

President Obama and his administration believes that just because they say it, it must be so. They believe that audiences somehow leave their God given brains at home and pant like Pavlovian dogs at whatever Obama or his spokesperson says.

Doubt me?

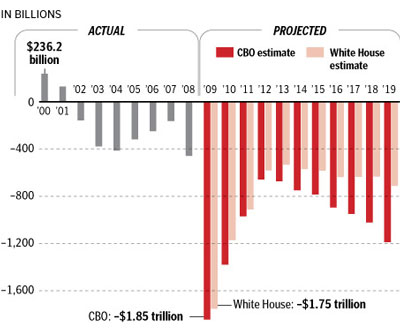

Obama is out pushing his medical insurance programs. He claims that by implementing the new plan he will reduce costs. Unfortunately for Obama, the CBO came out today and blasted his assumptions saying Obama’s plan will add an additional $1 Trillion to the deficit (remember, this is the deficit that Obama continues to claim he “inherited” and that he would cut in half) and that it will only cover an additional 16 to 17 million people.

Folks, if the net cost over 9 years to cover an average of 16.5 million people is $1 Trillion, that averages to over $6,700 per year, per person. For the average family of four, that is almost $27,000 per year. As a self employed individual I buy my family’s insurance so believe me I know how expensive health insurance is. However, $6,700 per year for your average individual isn’t just covering the basics, that’s enough to cover with a gold plated plan. It appears that once again, with government involved, costs don’t come down, they go up.

I think I hear the national health plan boo birds warming up in the wings!