If you weren’t able to catch President Obama’s press conference tonight or if you’d purposely avoided it so that your head wouldn’t explode, I’ve got a recap of the Q&A period. I’m not saying that what I’ve laid out is a verbatim recitation of what was said but, it will give you the gist of both the question and answer…at least as I interpreted Obama answering it.

Q – Regarding the request for new ability to takeover financial institutions?

A – Financial institutions = bad

Government knows better than public

Bottom line:

More government control is always the right answer

Q – Why haven’t you asked the public to sacrifice more?

A – Workers unite!

If the government spends more we’ll all be better

Financial institutions = bad

Bottom line:

You’ll sacrifice a whole lot more, just give me time and pass my budget!

Q – Will you sign a budget that does not have a middle class tax cut or cap and trade?

A – We need to spend a lot more

We need to raise the cost of energy dramatically

We need government control of health care

Bottom line:

Don’t worry you’re sweet head. My ego will carry this through.

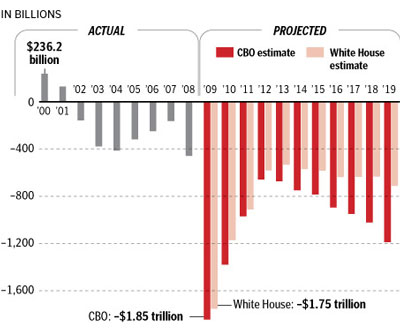

Q – Aren’t you passing on problems by dramatically increasing debt?

A – I inherited this from Buuuuuuuuuuuuuuush!

Growth only comes from government spending

The CBO can’t do math

Bottom line:

You’re damn lucky I’m here. This would really be a mess if Buuuuuuuuuuuush were still here!

Q – Why does you budget deficit go up dramatically in 6 of the next 8 years?

A – Did I call this a budget? This is really a guideline!

I can’t take over the entire economy in the first 2 months

Bottom line:

Quit asking me questions that I can’t answer!

Q – Do you consider the violence in Mexico a national security threat?

A – We’ll throw more money at the problem

The problem is that we don’t have gun laws

I’ll fix this next week over a tequila

Bottom line:

Don’t ask questions that could screw up my Mexican vacation

Q – Are you cutting defense spending?

A – I inherited this problem from Buuuuuuuuuuush!

Second only to the financial industry, military contractors = bad

Did I say we were withdrawing from Iraq?

Bottom Line:

I’m a Leftist. Of course I’m cutting defense!

Q – How come you didn’t come public on what you knew of AIG?

A – I like to know what I’m talking about before I speak

Bottom Line:

This would be the first and last time that will happen

Q – Are you concerned about the rising debt?

A – I’ve only been here 60 days!

We need government to control health care

Bottom Line:

Quit asking tough questions a second time

Q – How comfortable are you with foreign governments saying you’re spending too much?

A – China calling me Socialist….that’s rich!

Europe calling me Socialist…..that’s rich!

I’ll wow them at the G20!

Bottom line:

I’m planning another world tour. They’ll love me again after that!

Q – Are you reconsidering the mortgage and charity deduction cut?

A – No

Financial institutions, military contractors and rich people = bad

Charities will have to suck it up

Bottom line:

Hey, Joe and I don’t give to charities so this doesn’t impact us!

Q – Do you have a message for homeless children?

A – Just look at the jobs we’ve saved!

The States aren’t doing their jobs!

Obviously, we haven’t spent enough!

Bottom line:

If they had been aborted they wouldn’t be homeless

Q – Did you wrestle with your change on stem cell research?

A – I’m a deep, deep thinker

I said to myself, self and got no reply

It’s no harder a decision than abortion

Bottom line:

I’m the most pro infanticide President ever….stupid question. Next!

Q – Can you bring peace to the Middle East with a Neocon leading Israel?

A – Israel needs to give in

If George Mitchell stays awake long enough, he’ll make a trip there.

The Middle East is no different than the situation in Ireland

Bottom line:

We’re sending them an “Easy button” next week.