As is my custom when I “borrow” Tom’s 4-Blocks, the comments are off here to encourage you to go on over to his place. Tom truly is one of the unsung geniuses of the Cheddarsphere.

The repository of one hard-boiled egg from the south suburbs of Milwaukee, Wisconsin (and the occassional guest-blogger). The ramblings within may or may not offend, shock and awe you, but they are what I (or my guest-bloggers) think.

As is my custom when I “borrow” Tom’s 4-Blocks, the comments are off here to encourage you to go on over to his place. Tom truly is one of the unsung geniuses of the Cheddarsphere.

The “Bush’s fault” theme has been the favorite mantra of the ObamiNation, from its head to its foot soldiers, since Teh Won burst onto the scene. With that in mind, let’s update the chart I posted yesterday, itself an update of a chart the Washington Post put together during the debate on the first Obama budget last March, with another “baseline” projection from the CBO, this one from January 8, 2009, going out to FY2019.

Do note that the 2009 CBO baseline includes absolutely nothing that was passed in 2009, and very specifically does not include Porkul…er, the “stimulus” pack…er, the “Grow Government Act of 2009”. It also does, like the 2010 CBO baseline, assume the Bush tax cuts expire on schedule. Let’s run some numbers:

Given that, on January 20, 2009, the day that Obama assumed the office of President, the publicly-held debt (i.e. the cumulative deficit spending from the founding of the country up through the end of the George W. Bush administration) was $6.307 trillion (and that included a significant portion of the the 2009 “inherited” deficit), it is a mind-numbing number.

Bonus item – Speaking of that public debt amount, the public debt on the last business day of the Clinton administration (January 19, 2001) was $5.728 trillion. At the close of business this past Friday (1/29/2010), it was $7.759 trillion.

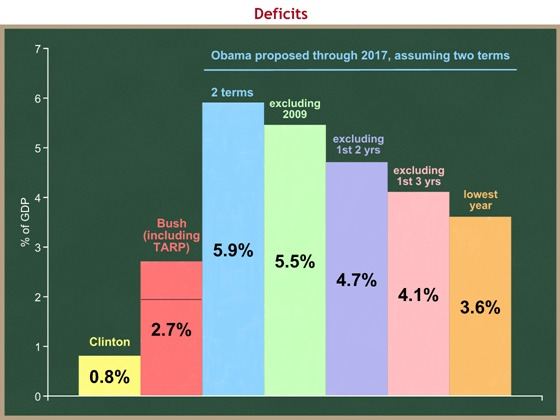

Revisions/extensions (3:39 pm 2/2/2010) – (H/T – Karl) Keith Hennessey provides more analysis, this time based on percentage of GDP instead of absolute dollars. Behold his more-colorful chart…

Do note that Hennessey assigns the entirety of the FY2009 deficit to Bush due to the effects of TARP. I dealt with that by using the CBO’s 2009 “baseline” from January 2009, which assigned just under $1.2 trillion of the FY2009 deficit to existing policies. Without the FY2009 budget, Bush’s deficits averaged 2.0% of GDP (that black line in the middle of Bush’s column).

However, neither that nor removing the first three years of “recovery” reduces Obama to anything near Bush deficit spending levels. The takeaway from Hennessey (emphasis in the original):

You can see that each of these comparisons, which allow you to “not count” the recovery years in the average for Obama, still result in average budget deficits that far exceed even the worst portrayal of the Bush Administration’s average.

In fact, the smallest annual deficit proposed by President Obama is 3.6% of GDP, in 2018 and 2019, the two years after his second term would end. The lowest during his hypothetical eight years would be 3.7% in 2017 and 2018. The lowest proposed budget deficits in a hypothetical “Obama decade” would exceed the Bush average budget deficit, even if we assign most of the TARP spending to Bush.

This leaves an open question: Which is the decade of profligacy?

R&E part 2 (6:23 pm 2/2/2010) – Thanks for the link love, and the treasure trove of links, go out to P-Mac. It’s all about making government bigger at the expense of everybody, but mostly the aspiring-to-be-rich.

R&E part 3 (11:50 am 2/3/2010) – Somehow I forgot to link to the January 2009 CBO report. Also, down in the comments, I explored both what keeping the third of the Bush tax cuts that Obama doesn’t want to keep and what keeping the Bush tax cuts in their entirety would have done had Obama and the Democrats not loaded up on the spending last year. Suffice it to say that the problem is not the tax cuts.

Doublespeak is one of the hallmarks of corrupt government. That highly relied upon source, Wikipedia, defines doublespeak as follows: “Doublespeak (sometimes called doubletalk) is language constructed to disguise or distort its actual meaning.” I will grant you that all politicians engage in this behavior to some degree. But just like a salesman’s “puffing” of a product can cross over into fraud, there is a point at which doublespeak crosses over into the realm of dangerous. Our President has crossed that line.

President Obama has responded to fear of excessive government spending by discussing his desire to get our federal deficits under control. He then rolls out a $3.83 trillion budget proposal. The assertion that such a budget proposal indicates any concern whatsoever for deficit spending is beyond comprehension. Doublespeak.

But it gets worse. Obama then goes on to repeat is mantra that it is all Bush’s fault. Believe me, I am no defender of Bush’s domestic policy or spending habits. But Bush’s last budget was $3.1 trillion. Obama has increased that number by 25%. But get this. The largest deficit under Bush was $407 billion. The current fiscal year deficit (Obama’s first) is about $1.5 trillion (the actual final number has not yet been determined). That is nearly four times Bush’s final deficit. And under Obama’s current proposal, next year’s deficit will be about $1.8 trillion. Using that standard, one could argue that Bush was down right frugal.

Obama’s next doublespeak comes in the form of a promise to fix our profligate spending habits by imposing a freeze on discretionary spending. Let me make it really simple. Let’s say I told my family that we really need to get our living expenses down, and here is my plan. This year we are going to increase overall household spending by about 25%. We’ll do the same in 2011. And during that time we are going to increase spending on shirts by 24%. Then, starting in 2012 we will freeze shirt spending for three years. Voila!! Birdman household budget fixed!!

I literally pray to God that people see through this nonsense and understand the peril we face if we continue down this path. This president literally frightens me.

A new report from University of Minnesota sociologist John Robert Warren shows participants in the Milwaukee Parental Choice Program graduated at a 18% higher rate than students in Milwaukee Public Schools in 2008, or 77% versus 65%:

High school dropouts earn less, contribute less to the tax base, and are more likely to go to prison — sobering facts that underscore the importance of a new study showing that the graduation rate for students in Milwaukee’s 20-year-old school choice program was 18 percent higher than for students in the Milwaukee Public Schools (MPS).

The findings, from a leading national expert who analyzed six years of data, estimate that 3,352 additional Milwaukee students would have received diplomas between 2003 and 2008 if public school graduation rates had matched those of low-income students using educational vouchers. Based on a separate study reported by the Milwaukee Journal Sentinel’s Erin Richards, the annual impact from 3,352 more MPS graduates would include an additional $21.2 million in personal income and $3.6 million in extra tax revenue.

“This new study deserves the attention of state and federal officials — including President Barack Obama — who seek education reforms that produce solid results,” said Jeff Monday, principal of Milwaukee’s nationally recognized Messmer High School.

The author of the new study, University of Minnesota Professor John Robert Warren, estimated a 2008 graduation rate of 77% for school choice students and 65% for public school students. The difference — twelve percentage points — translates into an 18% higher rate for voucher students. Dr. Warren found a similar average difference for the six-year period of 2003 through 2008….

The higher graduation rates for students in Milwaukee’s private school choice program are noteworthy because per pupil taxpayer support for choice students ($6,442) is less than half the $14,011 spent in the Milwaukee Public Schools.

In the new study, Professor Warren explains that eligibility for the choice program is limited to students from low-income families while “students in MPS schools come from a much broader range of social and economic backgrounds.”

Once again, it is not either the amount of money the parents have or the amount of money dumped into teachers, administrators, staff or facilities; it is motivated students, parents and teachers that make the difference in whether an education system is a success or a failure.

I came home from work and found a letter envelope from Homeland Security. Not sure that I really wanted to know the answer, I opened the envelope and found the following letter:

A few observations:

I’ve spent a considerable amount of my career involved with interactions with customers. If one of my staff brought this letter to me and said they were about to send it to a customer, my reaction would be, “Are you nuts? Even if it’s true, why would you be sending a letter to a customer telling them we’re incapable of doing our job?” I would follow that up with, “If this is true, we have a lot of work to do! We’re starting today and not stopping until we have a process that we can stand behind that is efficient and for which we can tell our customers how, what and why we are doing what we are doing!”

I’ll be flying again within the next couple of weeks. I’ll let you know if any of this gobbledygook actually translates to “I can fly” or whether I’ll be again relying on my Peter Pan happy thought to provide air transport!

Stay tuned.

In last week’s SOTU speech, Barack Obama suggested a 3-year non-defense/TARP/bailout discretionary spending “freeze”. Today, he unleashed a budget that, put together with his FY2009 and FY2010 budgets, will result in, by his administration’s own admission, another deficit of over $1 trillion ($1.27 trillion to be exact) in FY2011, a historic first-term (FY2009-FY2012) $5.07 trillion deficit (with a projected 4-year “low” of $0.83 trillion in FY2012), a “minimum” deficit of $0.71 trillion (in 2014), and a ten-year projected $8.53 trillion deficit between FY2011 and FY2020. Oh yeah; this year’s budget, at a projected deficit of $1.56 trillion, will top last year’s record $1.43 trillion deficit.

Those numbers are significantly worse than the “baseline” estimates released by the Congressional Budget Office just last week. The comparable numbers from the CBO estimates are a $1.44 trillion deficit this year, a $0.980 trillion deficit in FY2011, a $0.65 trillion deficit in FY2012, a “first-term” deficit of $4.48 trillion, a ten-year $6.05 trillion deficit between FY2011 and FY2020, and a “minimum” deficit of $0.48 trillion (also in FY2014).

A couple of side notes before I continue. First, while I could have used billions for the numbers under $1 trillion, I decided to keep the numbers in the same “base”. In the chart below, since the Washington Post used billions in their original, I decided to do so in my remake as well.

Second, a word of note about the CBO “baseline” – it assumes that the only changes to current tax law are those already part of law (e.g. the Bush tax cuts expire in their entirety, and the Alternate Minimum Tax doesn’t get its annual “fix), and that spending on discretionary spending increases at “only” the rate of inflation.

I’m sure you remember the chart from the Washington Post produced near the end of March comparing the OMB estimate of deficits in Obama’s FY2010 to the CBO estimate. Since Kevin Binversie appears to be looking for an update, I’ll provide one.

Click for the full-sized chart

Revisions/extensions (6:55 pm 2/1/2010) – In one of my previous drafts, I had the 10-year minimum deficit as projected by OMB today. Somehow, I had lost it in the published version. I have put it back in.

I told you last week about a new problem that that IPCC had with it’s MMGW “documentation.” That problem was that they had folks speaking as “experts” when in fact, at least one was a journalist!

WattsUp.com has the latest IPCC gaffe. It turns out that their claims of ice reductions on mountain tops was based on an article from a climbing magazine! Yup, again, no scientific measurement. Again, nothing but anecdotal hearsay by a people who no ability to comprehend that yes, climates do change but that doesn’t mean the change is caused by man.

I’m pretty sure that we are now just days away from finding that the core theory that global warming comes from CO2 emissions, was originally published in a 1930 Buck Rogers episode and in fact, has never been factually examined!

[No Runny Eggs is proudly powered by WordPress.]