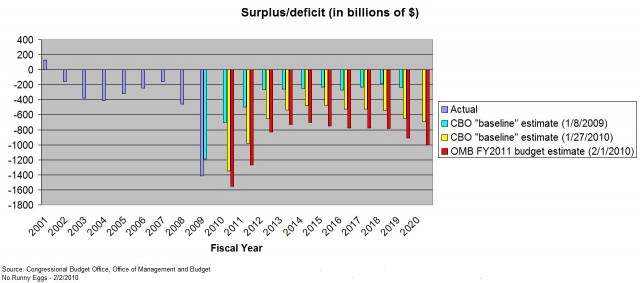

The “Bush’s fault” theme has been the favorite mantra of the ObamiNation, from its head to its foot soldiers, since Teh Won burst onto the scene. With that in mind, let’s update the chart I posted yesterday, itself an update of a chart the Washington Post put together during the debate on the first Obama budget last March, with another “baseline” projection from the CBO, this one from January 8, 2009, going out to FY2019.

Do note that the 2009 CBO baseline includes absolutely nothing that was passed in 2009, and very specifically does not include Porkul…er, the “stimulus” pack…er, the “Grow Government Act of 2009”. It also does, like the 2010 CBO baseline, assume the Bush tax cuts expire on schedule. Let’s run some numbers:

- In FY2009, Obama and his fellow Democrats added an additional $0.227 trillion in deficit spending (once again, I will use a single “base”) to what they “inherited” in deficit spending.

- In FY2010, they will add an additional $0.853 trillion in deficit spending, more than what they “inherited” in deficit spending.

- In FY2011, Obama wants to add an additional $0.769 trillion in deficit spending, close to double of the deficit spending he “inherited”.

- In FY2012, Obama wants to add an additional $0.564 trillion in deficit spending, more than double of the deficit spending he “inherited”.

- In his first 4 years (and hopefully, his only 4), Obama has added and wants to add $2.413 trillion in deficit spending on top of $2.651 trillion of “inherited” deficits.

- Through 2019 (the last year the comparison can be made), Obama wants to add $6.177 trillion in deficit spending on top of the $4.321 trillion he “inherited”.

Given that, on January 20, 2009, the day that Obama assumed the office of President, the publicly-held debt (i.e. the cumulative deficit spending from the founding of the country up through the end of the George W. Bush administration) was $6.307 trillion (and that included a significant portion of the the 2009 “inherited” deficit), it is a mind-numbing number.

Bonus item – Speaking of that public debt amount, the public debt on the last business day of the Clinton administration (January 19, 2001) was $5.728 trillion. At the close of business this past Friday (1/29/2010), it was $7.759 trillion.

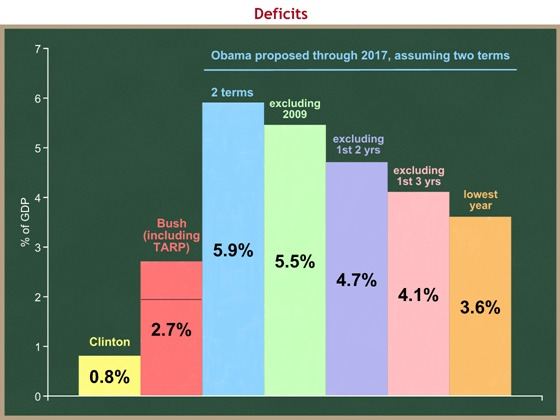

Revisions/extensions (3:39 pm 2/2/2010) – (H/T – Karl) Keith Hennessey provides more analysis, this time based on percentage of GDP instead of absolute dollars. Behold his more-colorful chart…

Do note that Hennessey assigns the entirety of the FY2009 deficit to Bush due to the effects of TARP. I dealt with that by using the CBO’s 2009 “baseline” from January 2009, which assigned just under $1.2 trillion of the FY2009 deficit to existing policies. Without the FY2009 budget, Bush’s deficits averaged 2.0% of GDP (that black line in the middle of Bush’s column).

However, neither that nor removing the first three years of “recovery” reduces Obama to anything near Bush deficit spending levels. The takeaway from Hennessey (emphasis in the original):

You can see that each of these comparisons, which allow you to “not count” the recovery years in the average for Obama, still result in average budget deficits that far exceed even the worst portrayal of the Bush Administration’s average.

In fact, the smallest annual deficit proposed by President Obama is 3.6% of GDP, in 2018 and 2019, the two years after his second term would end. The lowest during his hypothetical eight years would be 3.7% in 2017 and 2018. The lowest proposed budget deficits in a hypothetical “Obama decade” would exceed the Bush average budget deficit, even if we assign most of the TARP spending to Bush.

This leaves an open question: Which is the decade of profligacy?

R&E part 2 (6:23 pm 2/2/2010) – Thanks for the link love, and the treasure trove of links, go out to P-Mac. It’s all about making government bigger at the expense of everybody, but mostly the aspiring-to-be-rich.

R&E part 3 (11:50 am 2/3/2010) – Somehow I forgot to link to the January 2009 CBO report. Also, down in the comments, I explored both what keeping the third of the Bush tax cuts that Obama doesn’t want to keep and what keeping the Bush tax cuts in their entirety would have done had Obama and the Democrats not loaded up on the spending last year. Suffice it to say that the problem is not the tax cuts.

Revealed, but not a revelation: Middle class to get hit with “backdoor taxes” (UPDATE: ADMIN ANNOUNCES THAT REUTERS PULLED STORY)…

Update – 11:17 AM: I had just gotten this post published when WH press sec. Bill Burton announced on Twitter that Reuters had pulled the story. Here’s a screencap of the new page: The text: The story Backdoor taxes to hit middle class has b…

Here. Make it easy on your readers. The following link breaks down the current and projected budget deficit into major contributing factors, namely, the stimulus package, collapsing tax receipts, entitlements, Bush’s tax cuts, etc. The figure 1 is all you need to know about how we got where we are today and where we’re going if nothing changes:

http://www.cbpp.org/cms/?fa=view&id=3036

Nice try. However, as a believer in the Laffer Curve, I reject the notion that tax cuts, especially at the top end of the percentage of income taxed, cost the government significant amounts of tax revenue, and that increasing taxes on the top end significantly increases the amount of tax revenue. Moreover, if nothing is done, the Bush tax cuts are gone in their entirety by the end of 2011; therefore, any continuance beyond that point, at least as long as Obama is in office, is all on him.

Still, let’s take the Obama administration’s own numbers of what continuing the “top” third of the Bush tax cuts he doesn’t want to keep does to the 1/2009 CBO estimate (the last one that does not take into account any of the Obama/Democrat spending). The reason why only a third of the tax cuts are being taken into account is because Obama wants to continue the “bottom” 2/3rds, and thus he “owns” its effects. A note of housekeeping – for simplicity’s sake, I added a third of the aggregate “cost” of the tax cuts to the 1/2009 CBO estimate.

– In FY2010, the deficit would have increased from $0.703 trillion to $0.705 trillion. Significantly, that is the maximum deficit between FY2010 and FY2019, and lower than the minimum FY2011 OMB budget deficit.

– In FY2011, the deficit would have increased from $0.498 trillion to $0.543 trillion.

– In FY2012, the deficit would have increased from $0.264 trillion to $0.343 trillion.

– That would have left the “first-term inherited” deficit at $2.777 trillion, a far cry from either the 1/2010 CBO estimate of $4.392 trillion in deficit spending (reflecting the first-year Obama/Democrat spending priorities) or the 2/2010 OMB estimate of $5.064 trillion in deficit spending (reflecting Obama’s newest set of spending priorities).

– Going out to FY2019 (the last year the comparison can be made), the deficit would have increased from $2.651 trillion to $5.220 trillion, again much lower than either the first-year Obama/Democrat spending priorities ($8.123 trillion of deficit spending) or Obama’s newest set of spending priorities ($10.498 trillion of deficit spending).

I’m sure you’ll try to come back with, “But, but, but, but what about the entirety of the Bush tax cuts?” Adding the entirety of the Bush tax cut “costs”, and doing nothing else starting January 20, 2009 would have left the “first-term” deficit at $3.028 trillion, and the FY2009-FY2019 deficit at $7.019 trillion. The last time I checked, that’s significantly lower than the deficits under either the first-year Obama/Democrat spending priorities or Obama’s newest set of spending priorities over both timeframes.

[…] Nice Deb: Video: Las Vegas Mayor: “This President Is A Real Slow Learner” No Runny Eggs: How much of the deficit is Obama’s fault? Mcnorman’s Weblog: Schizophrenia Or Bald Faced Lying? GayPatriot: The Contradiction at the […]

[…] Bill Not a Stimulus Bill” Le·gal In·sur·rec·tion: No Offense to the Clueless No Runny Eggs: How much of the deficit is Obama’s fault? GayPatriot: The Contradiction at the Heart of Obama-ism CNN Money: Urban Unemployment […]

First things first: I don’t believe my comment stated that the tax cuts of 2003 created the current deficits we’re witnessing today. The collapse in tax revenues following financial crisis, the transfer of private debt on to the public sector from failing financial institutions and the stimulus measures taken in the aftermath of the crisis have a bit to do with our current situation I’d say. The idea that it’s possible to level off deficits in the short run, following a financial crisis of this magnitude is laughable. It defies logic and history. It’s horrible policy as well.

“However, as a believer in the Laffer Curve, I reject the notion that tax cuts, especially at the top end of the percentage of income taxed, cost the government significant amounts of tax revenue, and that increasing taxes on the top end significantly increases the amount of tax revenue.”

Recent historical data is not on your side (the left side if you believe in Laffer’s curve I guess) if you take into account the deficits created by Bush’s tax cuts (yes, nothing like we’re experiencing today), lackluster GDP growth, flat tax revenues and stagnant real wage growth for middle class Americans (all during a time period experiencing the largest asset bubble in world history).

The tax cut, especially for the top-tier, is nothing more than another method of deficit spending, given these current tax rates. That being said, I have no issues with the administration temporarily extending the cuts, given the current economic environment (however bad of a multiplier we generate from them).

Oh yes you did. Allow me to quote you from your first comment (emphasis added to refresh your memory):

One of the things the CBO does in its annual budget review is model what the economy does. The biggest component of the tax revenue collapse between 2009 projections and 2009 results was in the “economic profits” portion of the tax base, which is a direct result not of Bush policies, but of Obama/Democrat anti-business policies and rhetoric. Since the entities that have “economic profits” are the entities that provide jobs (or at least private-sector jobs), that collapse also fueled the higher-than-expected unemployment, which in turn has led to the looming cash deficits in the combined Social Security “Trust” Funds, a full decade earlier than what the Obama administration said last spring.

As for asset bubbles, I guess history started in 2001 for you, because you apparently never heard of the dot-com/NASDAQ bubble that happened in the late 1990s, with a burst in June 2000.

“….namely, the stimulus package, collapsing tax receipts, entitlements, Bush’s tax cuts, etc.”

Sure sounds like I’m talking about more than Bush’s tax cuts there.

Wait, wait, wait. You aren’t actually blaming the collapse in corporate earnings back in 2008 on the fear of Obama’s tax policy? Come on Steve. You might want to do some research on the effects of financial crisis thoughout history. To blame the collapse in global demand (and earnings as a result) on what MIGHT happen if Obama got elected is quite insane. I actally don’t think any economist on either side believes that hocus pocus. CUSTOMERS (or the lack thereof) drove the fall in corporate earnings, which translated into the collapse in tax receipts which led to the widening of deficits in this country. No one cares about the corporate tax rate going up 2% in 2011 when they don’t have anyone coming through the doors TODAY. 35% of zero earnings is zero last I checked.

“As for asset bubbles, I guess history started in 2001 for you, because you apparently never heard of the dot-com/NASDAQ bubble that happened in the late 1990s, with a burst in June 2000.”

……which was re-inflated by Greenspan, who kept interest rates exceptionally low (under pressure from the administration) for too long of a time period which helped to facilitate a real estate bubble not seen since the late 20’s. Same bubble, different asset classes. Oh and financial de-regulation in the name of efficient markets decades earlier didn’t help at all either.

[…] Can’t Ban Political Spending or Political Speech by Corporations in Elections No Runny Eggs: How much of the deficit is Obama’s fault? Mcnorman’s Weblog: Obama cries “uncle” finally! and Schizophrenia Or Bald Faced Lying? […]

[…] Can’t Ban Political Spending or Political Speech by Corporations in Elections No Runny Eggs: How much of the deficit is Obama’s fault? Flopping Aces: Obama Blames Bush Again….Surprised? Mcnorman’s Weblog: Obama cries […]

[…] Leading Democrat: “We’ve Got to Spend Our Way Out of This Recession” (Video) No Runny Eggs: How much of the deficit is Obama’s fault? Flopping Aces: Obama Blames Bush Again….Surprised? Mcnorman’s Weblog: Obama cries […]

[…] Can’t Ban Political Spending or Political Speech by Corporations in Elections No Runny Eggs: How much of the deficit is Obama’s fault? Flopping Aces: Obama Blames Bush Again….Surprised? Mcnorman’s Weblog: Obama cries […]

[…] Turn: Obama Budget Fashion Chic: Budget Freeze-OUT; Unsustainable Record Deficits-IN No Runny Eggs: How much of the deficit is Obama’s fault? Pundit & Pundette: Obama’s squandered […]