The price of a barrel of oil has increased nearly 50% since the first of the year. There has been much speculation as to what is driving the increase. The drop in the value of the dollar, increased usage from developing countries, tension in the Middle East, speculators and numerous factors have been pointed to as causing the run up. Certainly, each of these have impact on the price increase but I think one factor has been missed entirely.

Let me start with some background, in poker playing. When playing poker it’s important to not tell your opponent what you have in your hand. That seems pretty obvious. What’s not obvious to most folks is that telling another player what you have in your hand doesn’t typically involve spoken words. Good poker players can tell what their opponents think of their hands based on “tells.” “Tells” are unconscious body gestures, stroking your chin, pulling an ear, scratching your nose or a host of other things that the player may do each time they have a good, or a poor hand. A good poker player will identify and use those “tells” to determine what kind of hand their opponent has. Based on that information, they know how to bet.

So why has oil been increasing? The world oil market has been reading the “tell” of the US political system.

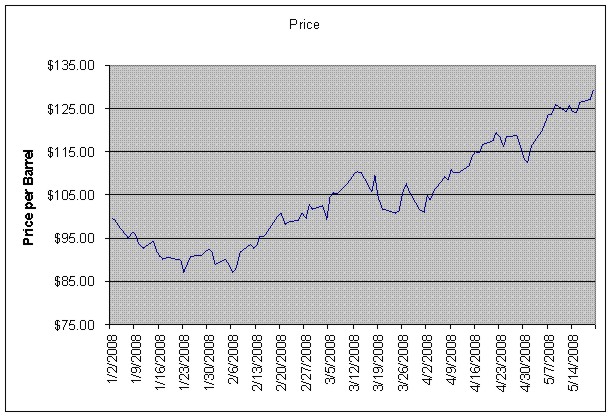

Look at this chart that shows the price of Light Sweet Oklahoma Crude (it tracks pretty close to the NY traded crude) by day of 2008.

oil-prices

oil-prices

OK, this would be a lot easier if I could draw arrows on graphs but….

Let me give you the events of a few dates:

- February 6, 2008 – Super Duper Tuesday and John McCain takes an early, substantial lead for the Republican nomination. (John McCain is anti ANWR.)

- March 4, 2008 – John McCain wins enough delegates to claim the Republican nomination. (John McCain believes in man made global warming and wants to institute a cap and trade system to carbon dioxide emitted from the burning of fossil fuels including oil.)

- April 1, 2008 – Congress grills Oil executives and threatens to remove tax deductions and impose other sanctions that will increase their costs

So what happened to oil prices along those same dates?

- February 6, 2008 – Oil began a price increase that saw it closing above $100 for the first time.

- March 4, 2008 – After failing to $105 for nearly 2 weeks, oil begins a drive that takes it to a close above $110 for the first time.

- April 1, 2008 – The begin of the most recent surge that has seen oil move, in a near linear fashion, to above $135.

I’m not saying that there is a direct cause and effect between the outlined activities and the move of oil. I am saying that the world oil market is getting consistent and repetitive “tells” that the US government, at all levels, is unwilling to do anything to increase the world’s oil supply. As examples, all of the remaining Presidential candidates have refused to drill for oil in ANWR and the Senate Energy and Natural Resources Committee recently caved to environmentalists and refused to expedited leasing for oil shale in Colorado.

Worse yet, the governement is giving “tells” that indicate that along with not increasing supplies, they will increase the costs of doing business for US oil companies. Examples of this are the Cap and Trade systems being proposed by the leading Presidential Candidates and demanding excess profits taxes on oil companies. Markets know that the impact of these items is that impacted companies will either reduce the availability of their products or increase their costs to the consumer.

The worse thing a beginning poker player can do is let their emotions get the better of them and bet irrationally hoping that that will improve the situation. The US has shown that trait with their multiple demands to Saudi Arabia for increased oil production as well as Congress’s passage of a bill that would allow it to sue OPEC for price setting and limiting supplies. Both of these are clearly actions of a frustrated player who sees no good options in their current hand.

Until the US starts a new hand and resets the odds by increasing the world oil supply by exploration and development within US territories, the world oil market will continue to hold a royal flush. If they hold a royal flush and know that we hold 5 unmatched cards, they will continue to bet into the pot and we will see continued increases in the price of oil.

Great information. I wish I could play poker like the polititions. How far will the MSM dig into this. Will anyone even dare to talk about our gov.and polititions roll in this fiasco, don’t think so. I can just see the latest headlines. It’s the republicans fault for voting for all this. If we only had a dem as president this would not have happened. If Algore would of won in 2000 we would have cheep gas and oil today. Yea right. Keep up the great work.

SB – I think you need to look at the Democratic side, too. I know that the stock market takes news of Obama’s success poorly. I think this applies moreso to oil.

The 2/4 and 3/6 dates also coincided with surprising Obama wins. We can now throw in 5/20, when BO declared victory in committed delegates.

Oil money understands that with a weak U.S. leader, international tensions will increase. Obama may be the next Jimmy Carter and this is being factored into oil futures.

HB

Though I do agree that in the long run we should explore more I also support diversification and there are many new exciting developments that have made solar more efficient and economical. The value of the global economy has soared from $36 trillion to $70 trillion in the last 8 years alone. That number will continue to grow and will probably accelerate. For anybody fighting the war on poverty, that figure should be good news.

Christopher – solar, wind and even nuclear are canards that the politicians and MSM spout to give folk’s the impression that there are solutions other than oil. They are worth exploring but oil supplies less than 2% if our electricity which is what those technologies are focused on. Oil is the only solution we have today for transportation…this is the MAJOR piece that gubmint wishes wasn’t true but is.

Headless – no doubt on the Dems but I think they have been assumed to be bad for energy policy. What has thrown this over the edge is that we have an alleged Republican that is walking in lockstep with them. I thought the dates were interesting and just happened to correspond to oil direction but I don’t think the markets react quite like that. I do think that the direction is being driven by the perspective that regardless, the US govt. is loathe to increase production.

Paul – You can play poker like the politicians. You just need to use someone elses money and you bet as stupidly as you like! The one hope I have is I’m starting to see some polls that the US citizenry is starting to get it…not quite ready to throw the tea over the side yet but it’s getting momentum.

Shoebox–as to “tea….momentum,” I am near unto purchasing another .30-06 and lots more ammo…

Interesting thesis, by the way, and well-presented. I’m inclined to grant that MOST of the runup has to do with McCain/DemocratX’s willingness to be supine and offer US citizens as sacrifices to the god of Ecological Correctness.

Other factors are also present: China/India subsidization of oil prices for their consumers; possible war with Iran; and the fall of the USdollar.

As to nukes–that will relieve the strain on natural-gas supply, and natural gas IS a “possible” auto fuel (but not lubricant.)

What’s being ignored is the also-very-high price of natural gas…

Dad – Dickie-adoodoo & his many minions were bigtime into gas fired power in the late 1990’s. It was almost ‘too cheap to meter’ then, and was the fuel they chose for increased capacity for the 21st century.

I put new nukes in the same category as ANWR. Nice in theory, but they take a long time to implement. There is also a huge problem with the aging workforce (they may never let me retire) and work that is beneath the dignity of the 20-something barrista generation.

The price also surged quite a bit when the Dem’s and RINO’s shot down the ANWAR idea again. The oil producers know that we pretty much have tapped out all of our oil resourses and will do nothing to get new oil- same with new refineries. Then the same week, the Fed’s put the polar bear on the endangered list, which may make it even harder to get oil. So, thanks to the libs, Dem’s or RINO’s we have $4.00 a gallon gas and it will get much worse.

Dad29 – yup I hope I was clear that there are many other contributing factors. My point was that the coup de gras, the reason it continues to roll forward is that we’ve told them we aren’t going to do anything to change it. As to natural gas for fuel…yup again however, we can covert coal into gas at about $60/barrel, oil shale less than $100…again, environmentalists have the DC weanies tied in knots. I know you are fond of quotes…how about the definition of insanity!

“OK, this would be a lot easier if I could draw arrows on graphs

Are you using WinDoze of any type? Right-click on the *.JPG, go down and click “Open With”, select “paint”, and open it (uh, do NOT check “always open with” box).

I’m sure the sourApple system and other various Unix types have some equivalent.

Randomized thoughts:

– Actions, or more-properly, lack of actions do have consequences, especially at the extreme end of the supply/demand curve with said curve moving further along the demand-outstripping-supply territory.

– Natural gas is the next domino in the explosion of energy prices, one that will go off right about the election (I’m thinking at least $18/10,000 million BTU by Christmas compared to $11 and change now). The price of natural gas has historically been a cyclical, seasonal fluctuation much like heating oil has. The difference this year is there has not been any seasonal pullback. Gee, I wonder why </sarcasm>.

– Related to natural gas, while it was a prefered source of generation for We Energies, it fortunately was never the sole one. Can you imagine the cost of electricity if the new generators in Oak Creek would have been natural gas instead of coal?

– Electricity for transportation just isn’t going to work up here in the Snow Belt, whether it’s generated from coal, natural gas, nuclear, wind, solar, hydro, or biocrap. Anybody who has left a car outside overnight in a January freeze can tell you that a battery holds but a fraction of the charge it holds in July.

has it occurred to anyone that the bush family owns oil companies of their own? i am not skilled in the corrupt system known as politics, but i can see that the bush family may have SOMETHING to do with this, maybe not a huge piece, but a piece nonetheless; just goes to show another wonderful thing about the illiterate dumbass in office for another 6 months.

Chaz, you’re right. How could I have missed it! The stock certificates are in plain sight right next to the thermostat that allows President Buuuuuuuuuuuuush to control the climate temperatures!