The price of a barrel of oil has increased nearly 50% since the first of the year. There has been much speculation as to what is driving the increase. The drop in the value of the dollar, increased usage from developing countries, tension in the Middle East, speculators and numerous factors have been pointed to as causing the run up. Certainly, each of these have impact on the price increase but I think one factor has been missed entirely.

Let me start with some background, in poker playing. When playing poker it’s important to not tell your opponent what you have in your hand. That seems pretty obvious. What’s not obvious to most folks is that telling another player what you have in your hand doesn’t typically involve spoken words. Good poker players can tell what their opponents think of their hands based on “tells.” “Tells” are unconscious body gestures, stroking your chin, pulling an ear, scratching your nose or a host of other things that the player may do each time they have a good, or a poor hand. A good poker player will identify and use those “tells” to determine what kind of hand their opponent has. Based on that information, they know how to bet.

So why has oil been increasing? The world oil market has been reading the “tell” of the US political system.

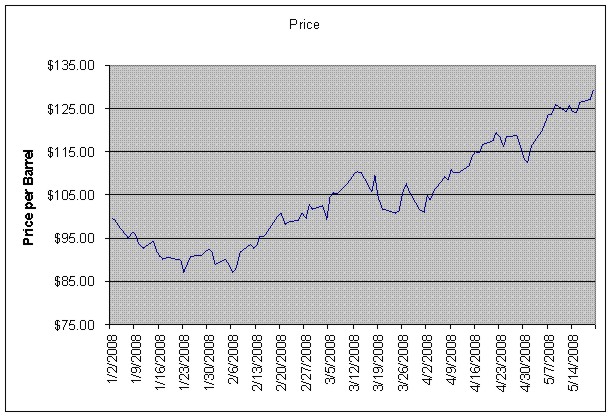

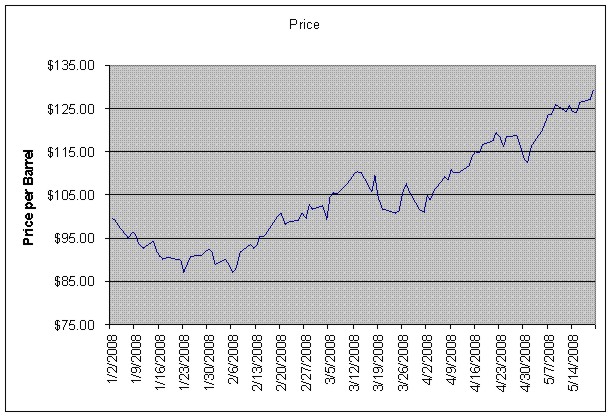

Look at this chart that shows the price of Light Sweet Oklahoma Crude (it tracks pretty close to the NY traded crude) by day of 2008.

oil-prices

oil-prices

OK, this would be a lot easier if I could draw arrows on graphs but….

Let me give you the events of a few dates:

- February 6, 2008 – Super Duper Tuesday and John McCain takes an early, substantial lead for the Republican nomination. (John McCain is anti ANWR.)

- March 4, 2008 – John McCain wins enough delegates to claim the Republican nomination. (John McCain believes in man made global warming and wants to institute a cap and trade system to carbon dioxide emitted from the burning of fossil fuels including oil.)

- April 1, 2008 – Congress grills Oil executives and threatens to remove tax deductions and impose other sanctions that will increase their costs

So what happened to oil prices along those same dates?

- February 6, 2008 – Oil began a price increase that saw it closing above $100 for the first time.

- March 4, 2008 – After failing to $105 for nearly 2 weeks, oil begins a drive that takes it to a close above $110 for the first time.

- April 1, 2008 – The begin of the most recent surge that has seen oil move, in a near linear fashion, to above $135.

I’m not saying that there is a direct cause and effect between the outlined activities and the move of oil. I am saying that the world oil market is getting consistent and repetitive “tells” that the US government, at all levels, is unwilling to do anything to increase the world’s oil supply. As examples, all of the remaining Presidential candidates have refused to drill for oil in ANWR and the Senate Energy and Natural Resources Committee recently caved to environmentalists and refused to expedited leasing for oil shale in Colorado.

Worse yet, the governement is giving “tells” that indicate that along with not increasing supplies, they will increase the costs of doing business for US oil companies. Examples of this are the Cap and Trade systems being proposed by the leading Presidential Candidates and demanding excess profits taxes on oil companies. Markets know that the impact of these items is that impacted companies will either reduce the availability of their products or increase their costs to the consumer.

The worse thing a beginning poker player can do is let their emotions get the better of them and bet irrationally hoping that that will improve the situation. The US has shown that trait with their multiple demands to Saudi Arabia for increased oil production as well as Congress’s passage of a bill that would allow it to sue OPEC for price setting and limiting supplies. Both of these are clearly actions of a frustrated player who sees no good options in their current hand.

Until the US starts a new hand and resets the odds by increasing the world oil supply by exploration and development within US territories, the world oil market will continue to hold a royal flush. If they hold a royal flush and know that we hold 5 unmatched cards, they will continue to bet into the pot and we will see continued increases in the price of oil.